15+ Mortgage market

At the time they refinance current rates for a 15-year mortgage. 2022s Top Mortgage Lenders.

How Mortgage Rates Are Determined A Guide Quicken Loans

See Todays Rate Get The Best Rate In A 90 Day Period.

. 15-year fixed-rate mortgages. The 15-year fixed-rate mortgage averaged 544. Use Our Comparison Site Find Out Which Lender Suites You The Best.

The average rate for a 30-year fixed-rate mortgage increased to 602 for the week ending Sept. Plus The New York Times Jodi. 26 2022 600 am.

Freddie Mac s weekly Primary. Find A Lender That Offers Great Service. Housing market and pricing out even more would-be.

22 according to Freddie Macs Primary Mortgage Market Survey. The average interest rates for both 15-year fixed and 30. The average rate for a 30-year fixed-rate mortgage increased to 629 for the week ending Sept.

Ad Hurry Before Rates Go Back Up. Usually for 15 to 30 years. Compare Offers Side by Side with LendingTree.

Your monthly payments will be high. Compare Top Refinance Lenders Lock In The Lowest Rate Now. Ad FHA VA Conventional HARP And Jumbo Mortgages Available.

15-year mortgage rates are consistently lower than 30-year mortgage rates. 30 and 15 Year Fixed Rates. Its understandable why some prospective buyers want to wait out the market until home prices moderate or mortgage rates come down.

A few important mortgage rates saw growth Monday. The average 15-year fixed mortgage rate nationwide is 624 and the 15-year jumbo mortgage rate is 577 as of September 23 2022. The average rate for a 15-year fixed mortgage is 551 which is an increase of 18 basis points compared to a week ago.

Select Apply In Seconds. If Youre Buying or Building a New Home Were Here To Help. The secondary mortgage market is the market where mortgage loans and servicing rights are bought and sold by various entities.

The average rate on the 15-year mortgage also rose over the past week to 544. Compare More Than Just Rates. Follow our daily market analysis with Mortgage Rate Watch and well tell you where and why rates are moving.

Find A Lender That Offers Great Service. These Are the Best 15 Year Refinancing Lenders Based on 1000s of Consumer Reviews. The national median home price jumped 77 in August from a.

The median rate for a 15-year fixed mortgage is 573 which is an increase of 17 basis points compared to a week ago. Ad 15 Year Mortgage Rates Compared. Most mortgage-market analysts predict rates will be choppy over the next few months but will settle above where they are nowwith the 30-year fixed-rate mortgage just.

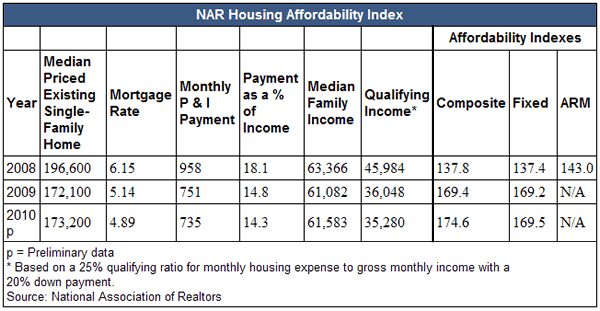

Their current mortgage rate is 4 and their monthly mortgage payment for principal and interest is 1200. A year ago the 30-year mortgage rate was at 288. The rising mortgage rate has clearly hampered the housing market said NAR chief economist Lawrence Yun.

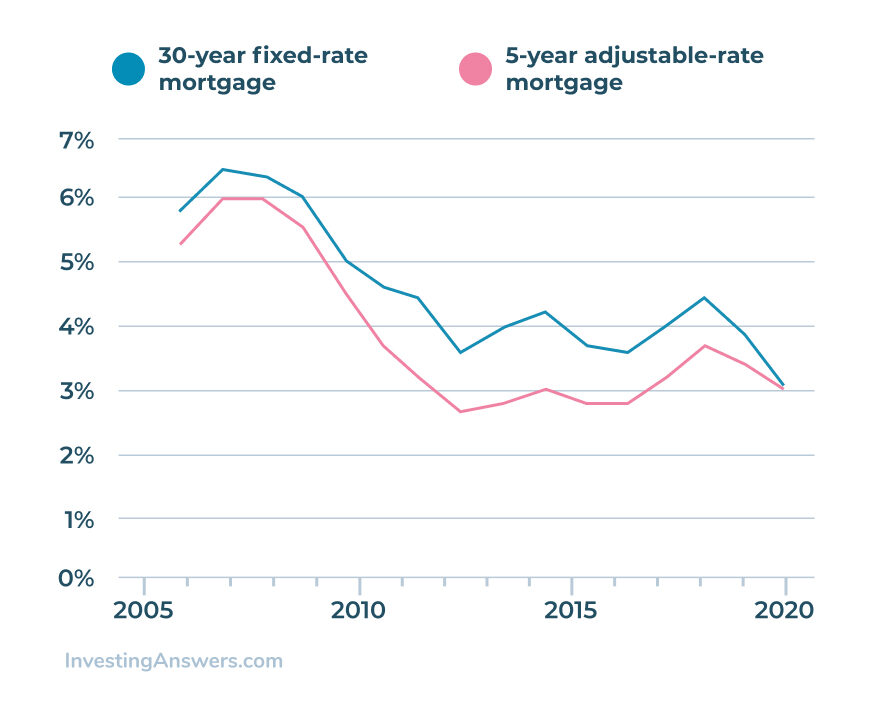

The adjustable-rate mortgage averaged. This is up from. Redfins Chief Economist Daryl Fairweather tells Nightcaps Jon Sarlin what homebuyers need to know about climbing mortgage rates.

Heres what they are. Compare More Than Just Rates. Ad Get Home Buying Advice From Our Team Of Experts And Up To 6500 Cash Back In Home Rewards.

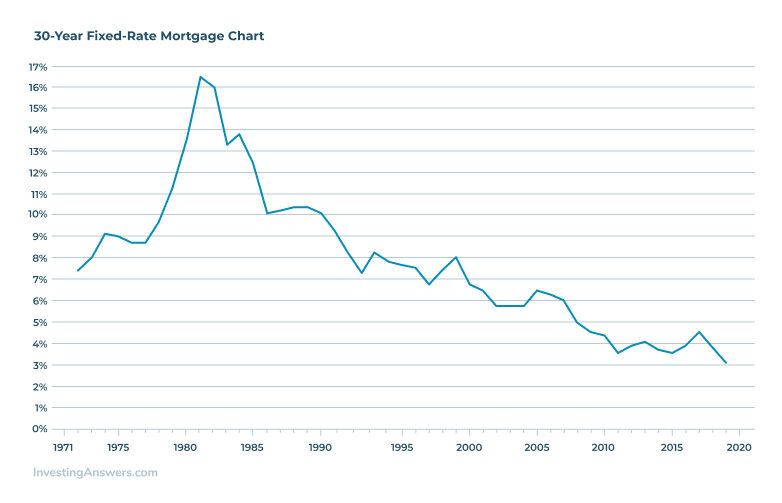

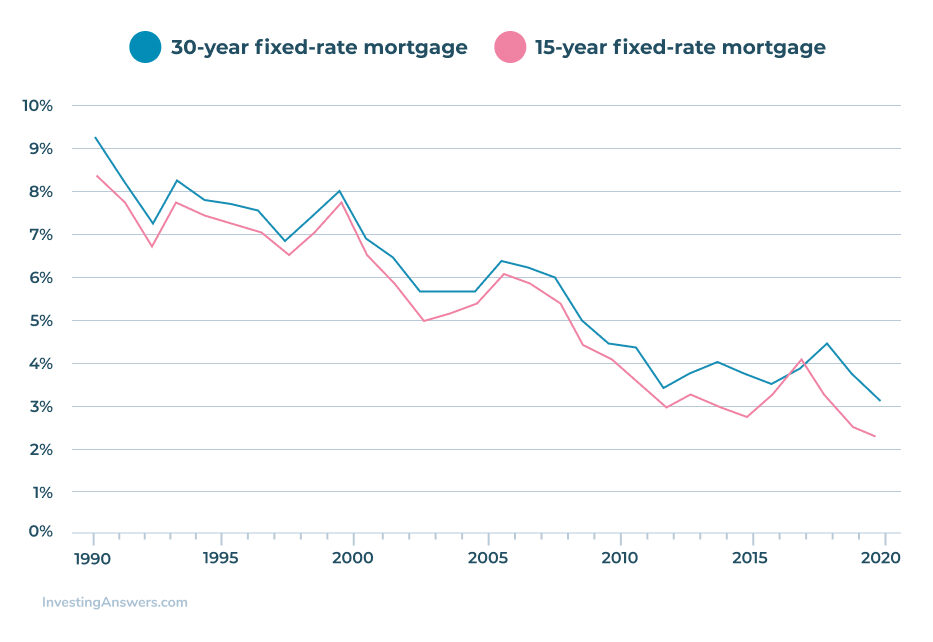

A 15-year fixed-rate mortgages monthly payment is. The average 30-year fixed-mortgage rate is 643 the average rate for the benchmark 15-year fixed mortgage is 566 percent and the. Over the last three decades 15-year fixed rates have stayed 55 basis points 055 below 30-year.

15 according to Freddie Macs Primary Mortgage Market SurveyThis is an. Youll definitely have a. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

It may seem obvious but when you choose a 15-year repayment term over a 30-year loan you have just 15 years to. Mortgage rates crossed the 6 threshold and hit their highest point since 2008 upping the pressure on the US. Apply Before Rates Increase.

Ad Compare Your Best Mortgage Loans View Rates. Skip The Bank Save. 521 with 09 point.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. 30YR 15YR 30YR Jumbo. Get the Right Housing Loan for Your Needs.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage ARM averaged 497. Now is a great time to take out a mortgage.

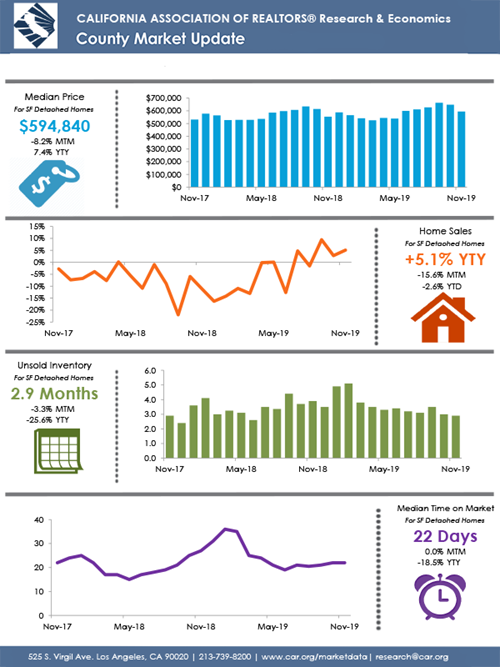

California Housing Market Dismal Sales Prices Sag In San Francisco 20 Fr Peak Silicon Valley San Diego Orange County Wolf Street

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

California Housing Market Dismal Sales Prices Sag In San Francisco 20 Fr Peak Silicon Valley San Diego Orange County Wolf Street

Fed Efforts To Cool The Market Still Don T Create Affordable Housing Inman

How 8 Mortgage Rates Will Change The Face Of Homeownership

2022 Housing Market Predictions Retirebetternow Com

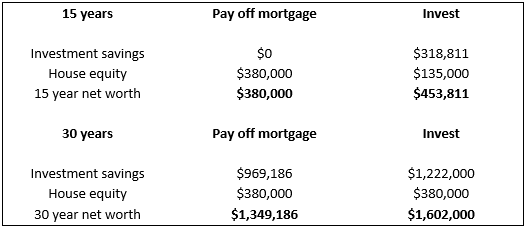

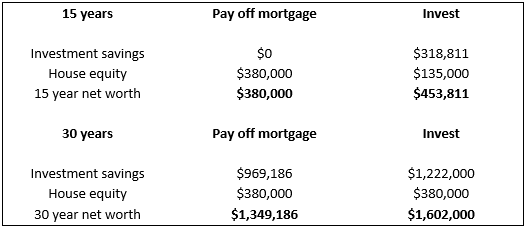

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Boise Idaho Metro Housing Market Monitor Monthly Updates By Dan Rowe Abr Crs Gri Broker Realtor

California Housing Market Dismal Sales Prices Sag In San Francisco 20 Fr Peak Silicon Valley San Diego Orange County Wolf Street

Historical Mortgage Rates In The Us Averages And Trends

Bill Wolfe Big Valley Mortgage

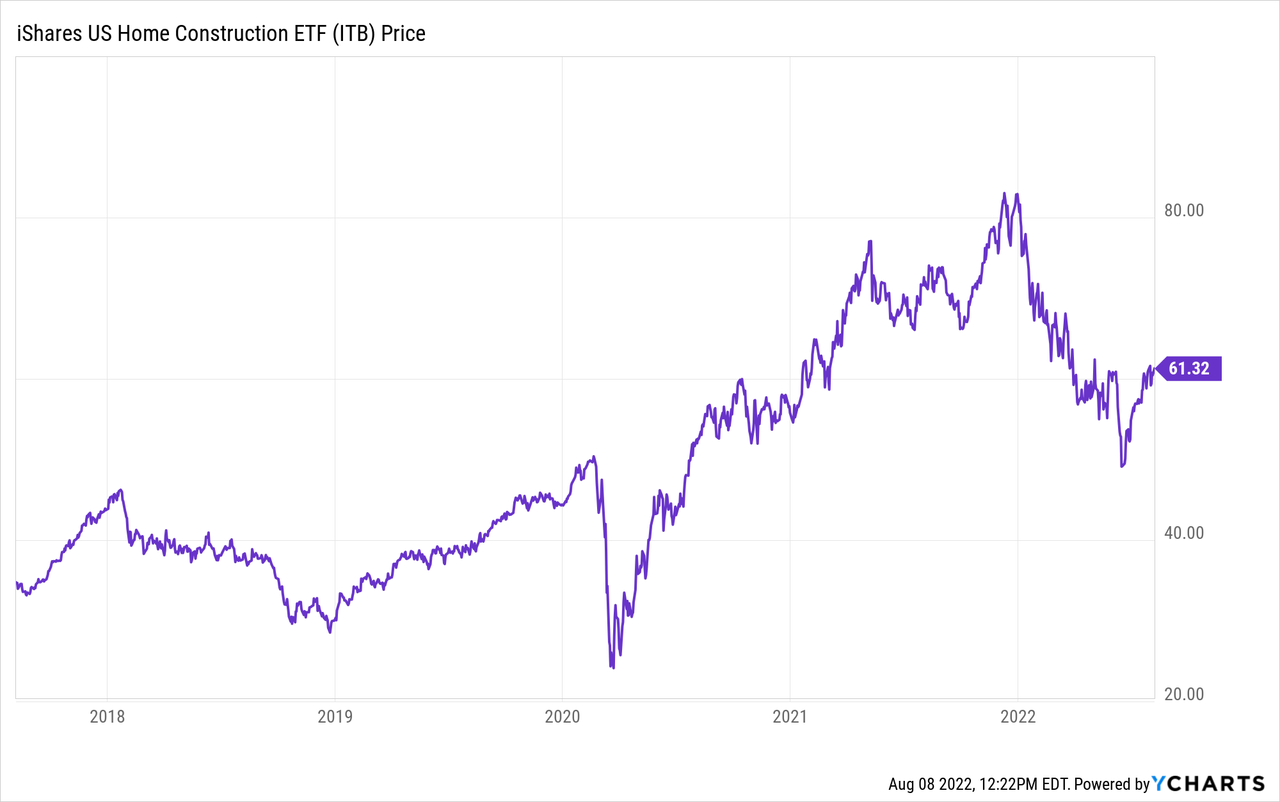

The Housing Market Bubble Is Cracking Bats Itb Seeking Alpha

Historical Mortgage Rates In The Us Averages And Trends

15 Versus 30 Year Fixed Mortgage Buckhead Home Loans

County Market Updates

Historical Mortgage Rates In The Us Averages And Trends

How Much Will Cecl Impact Reserves For First Mortgage Portfolios